9th September 2025 > > MSTR, QMMM, & DOGE.

- Mark Timmis

- Sep 10, 2025

- 3 min read

tl;dr

MSTR did not make it into the S&P 500, much to my surprise. QMMM shareholders are feeling very pleased with themselves. A DOGE ETF will start trading tomorrow, wrong-footing some investors in the short term.

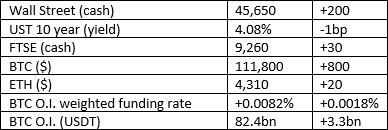

Market Snap

Market Wrap

Weirdly, I had a dream last night that BTC was trading at $12,947, a rather precise figure last seen in 2020. What an opportunity that would be, possibly even justifying a huge leveraged bet with collateral down to a price of zero. Sadly, it is never going to happen. Those days are long behind us.

Curious Cryptos’ Commentary – Strategy Inc.

Last week the CCC reported that Strategy (MSTR) was likely to be admitted to the S&P 500 with an announcement to that effect last Friday effective from September 19th.

Unfortunately, I got that one wrong, so for now all those passive funds tracking the S&P 500 will not yet be scrapping to buy MSTR shares from the weak hands.

Next time round, eh?

Curious Cryptos’ Commentary – QMMM

Yesterday, QMMM a Hong-Kong based investment company announced a pivot towards cryptos in its operations as well as a treasury reserve comprising BTC, ETH, and SOL to the tune of $100mm:

The stock price rallied a rather impressive 1,737% from $11 to $207 topping out at over $250:

Two things to note.

If you are holding QMMM stock, please do seriously consider taking some profits.

Secondly, it will soon be standard practice for all companies to have some degree of cryptos on their balance sheet. The sooner we all understand that will happen, the better it will be for us.

Curious Cryptos’ Commentary – DOGE ETF

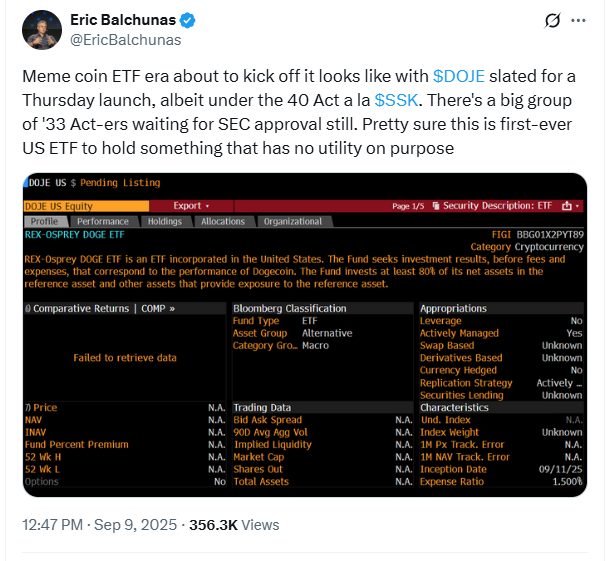

Rex-Osprey are launching a DOGE ETF tomorrow filed under the Investment Company Act of 1940 instead of the Securities Act of 1933, like all other crypto ETF filings:

By using the 1940 legislation rather than the 1933 rules, the process of approval by the SEC is streamlined. Currently there are over 90 spot crypto ETFs under scrutiny by the SEC including a handful of other DOGE applications. Which rather begs the question as to why this approach has not been tried before.

The key difference is that this ETF will use derivatives to mimic the price action of DOGE instead of buying the underlying.

As we saw with the launch of BTC futures ETFs in October 2021, the price impact upwards was merely speculative, as the ETFs didn’t own any actual BTC. There is an unlimited supply of BTC futures, as there is for any asset. So, we must temper our expectations about this specific DOGE product.

What it will do though is ease the progress of the physical spot DOGE ETFs currently under consideration by the SEC, in the same way that the launch of futures BTC ETFs made it inevitable that spot ETFs would follow despite SEC resistance at the time. Elon Musk’s favourite coin may be about to go mainstream benefitting all current holders.

…

For disclosure purposes, the CC Treasury has long held DOGE, now at a negative acquisition cost after having sold 17% of the original notional that has more than repaid the initial investment. This is a pleasing position to find oneself in, and is surely the first objective to target when investing in alts (https://www.curiouscryptos.com/post/14th-august-2025-dats-selling-alts).

Comments