8th July 2025 > > Rejoice! Prices & scams.

- Jul 8, 2025

- 3 min read

tl;dr

Rejoice! For the interregnum is finally over. The curious case of BTC’s current lack of enthusiasm to consistently reach new ATHs. A Ledger scam worth taking note of.

Market Snap

Market Wrap

Despite more noise and fury about the Trump Tariff Wars, spot BTC ETF inflows remain strong (over $1.2bn in the last three days alone) underpinning the price of BTC, but not driving us to ever newer highs, which some find odd. More on that topic below.

Though perhaps we will see more of this soon enough:

Curious Cryptos’ Commentary – Why isn’t BTC consistently breaking new highs?

Each day, just 450 BTC are produced by the miners, with a total value of close to $50mm at today’s prices. The almost insatiable appetite from the spot BTC ETFs, running at an average of several hundred million dollars daily of late, dwarfs that supply. Economics 1.0 tells us that for any commodity, such a demand/supply imbalance must result in price rises. Which we have seen to a certain extent, but not as much perhaps as one would expect. How can that be?

Last week, a set of 14-year-old wallets woke up and moved 10,000 BTC per wallet to new native segwit addresses, with a total value of $8bn:

Deposited in 2011, when BTC was trading at about a cent – suggesting a total acquisition cost of around $800 (the trade of the Millenium I suspect) – this is the kind of source of BTC that OTC desks desperately seek to satisfy the demands of institutional investors, via ETFs or directly.

It seems probable to me (contrary to Arkham’s conclusion) that the original owner has transferred these coins to a reputable custodian (probably Coinbase) which now has the mandate to sell the coins to OTC desks for distribution to institutional investors at a laddered series of exit prices. As the OTC desks will also custody those coins at Coinbase, as will the subsequent beneficial recipient, they may never move again – the legal and financial ownership will be recorded in the documented agreements between Coinbase, the OTC desks, and the ETF providers, not on-chain.

This is clearly not the world that maxis envisioned, but there are other implications too.

As the legal entitlement to the price performance of BTC, both up and down, becomes ever more embedded off-chain, the information one can derive from looking at the blockchain itself becomes distorted and unrepresentative of actual events. This might explain why Arkham (a blockchain intelligence company) comes up with a different justification to mine.

This is a sad irony here, for the blockchain provides far greater clarity with regards to nefarious activities such as drug-dealing, money laundering, and terrorist financing, than any other source of information. The authorities have long pushed to move to a cashless society, believing that they would gain greater control, only to find out that the TradFi banking system is as ridden with holes, and the means to escape detection, as traditional cash.

The anti-libertarians, those naysayers with no morals, or any understanding of the concept of privacy for others, though wanting to keep it for themselves, have claimed that BTC is a conduit for these bad actors, when all the evidence suggests otherwise.

As an obvious example, J.P. Morgan has been fined billions and billions of dollars for facilitating illegal transactions, not just as a one-off, but on an ongoing yearly basis. Those fines are seen as a cost of doing (illegal and immoral) business. No wonder Jamie Dimon, CEO of J.P. Morgan is so anti-crypto, for it provides an existential challenge to his business model.

The TradFi-ification of BTC now means it will become as attractive to bad people as the current banking world, which is a shame.

Curious Cryptos’ Commentary – Ledger scam alert

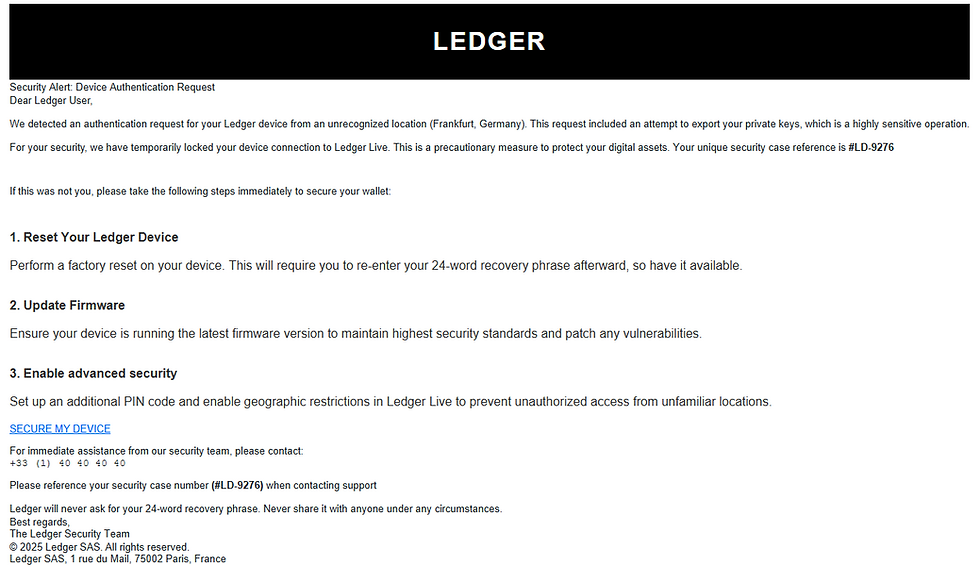

This curious email popped into my inbox:

There are several giveaways, starting with the sender’s email address:

The factual inaccuracies are laughable e.g. “Thіѕ rеquеѕt іncludеd аn аttеmpt tо еxpоrt yоur prіvаtе kеyѕ …” which simply isn’t a function available in the Ledger ecosystem. If you didn’t know that before, you do now. Also, “… wе hаvе tеmpоrаrіly lоckеd yоur dеvіcе cоnnеctіоn tо Lеdgеr Lіvе” which, again, simply isn’t a function available in the Ledger ecosystem.

Clicking on the link takes you to a page that asks you to enter your secret phrase so that it can “Check if your Ledger has been compromised”. Yeah right.

This is the secret phrase I shared, which pleasingly perfectly fits the 12-word option:

I am sure you all concur.

Comments