7th December 2023 > > Naysayers.

- Dec 7, 2023

- 2 min read

tl;dr

Worried, confused, and feeling threatened by the onset of this crypto bull run, the naysayers are out in force trying to pretend otherwise.

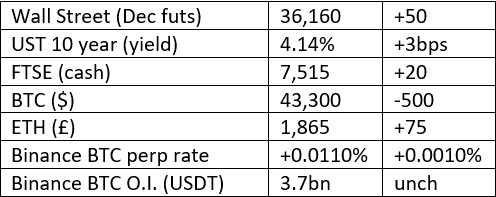

Market Snap

Market Wrap

Perpetual futures funding rates are a sea of red, implying that leveraged longs are getting over their skis. A correction would be healthy, and we might just get one if the longs get liquidated.

Curious Cryptos’ Commentary – Jamie “You can’t fire me” Dimon

J.P. Morgan’s long-standing CEO took no responsibility for his firm’s leading role in the sub-prime crisis that led to an existential threat to the global banking system until the U.S. stepped in with TARP (Troubled Asset Relief Program). He certainly wouldn’t allow himself to be fired for his role in that financial fiasco. He has forever been a crypto naysayer.

In choreographed comments with Senator Elizabeth Warren – who has her own personal “anti-crypto” army – during a Senate Banking Committee, Dimon shows the extent of his ignorance with the comment that the authorities should “close down” Bitcoin, as if such a thing was a realistic prospect:

“The true use case for it [crypto] is criminals, drug traffickers, money laundering, tax avoidance. If I was the government, I’d close it down.”

Those tired old tropes have been roundly rejected too many times to go over the same ground again, though Dimon is free to demonstrate that he has zero curiosity about understanding the reality of the situation.

But what gets many people annoyed, is the sheer hypocrisy of his – and Warren’s – position:

“FinCEN today (7th January 2014) fined J.P. Morgan Chase Bank, N.A. $461mm for wilfully violating the Bank Secrecy Act by failing to report suspicious transactions arising out of Bernard L. Madoff’s decades-long, multi-billion-dollar fraudulent investment scheme.”

Or:

“J.P. Morgan to pay $75mm to settle lawsuit over ties with Jeffrey Epstein.”

In total, J.P. Morgan has been fined TWO HUNDRED AND SEVENTY-TWO times since 2000 for illegal activity, paying nearly $40 BILLION in fines.

That’s a whole lot of facilitating “criminals, drug traffickers, money laundering, tax avoidance” implicit in J.P. Morgan’s day to day business model. Or, at the very least, tolerated, proving again the need for a decentralised system to sit alongside current centralised processes.

Dimon is responsible for all of this as he is the CEO, but he remains firmly in place. His moniker has been well-earned.

Curious Cryptos’ Commentary – How to call the market bottom?

Simple. Just read the ECB’s blog posts and do the opposite. Same as the Jim Kramer situation.

This spectacular one published 30th November 2022 when BTC was trading at $16,400, made the astonishing claim that BTC was on an “artificially induced last gasp”:

Head of the ECB, Convicted Criminal Christine Lagarde, sits on the Warren-Dimon-Buffet axis with regards to cryptos. We all have our own prejudices, but this is a salutary example of how we should always be aware that our prejudices may colour and confuse our thinking, to the extent that we risk ending up looking like idiots.

Comments