26th September 2022 > > Reversible transactions.

- Mark Timmis

- Sep 26, 2022

- 3 min read

tl;dr

Reversible transactions maybe anathema to some maximalists, but they do offer greater security.

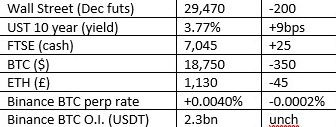

Market Snap

Market Wrap

GBP had a rough night, attracting buyers of UK stocks.

More importantly, 10-year yields hurtling towards 4% are hurting US stocks and cryptos alike.

Curious Cryptos’ Commentary – Apple’s App Store

The App Store will allow apps selling NFTs, with a hefty 30% commission on all sales, which will continue to be denominated in fiat.

Why do we care? This potentially provides an ETH wallet to one billion or so iPhone users, driving crypto understanding and adoption on a grand scale.

Curious Cryptos’ Commentary – Reversible transactions

One of the selling points for blockchain technology is its immutable nature.

Though theoretically a 51% attack can change the history of a blockchain, once a certain level of decentralisation is in place, it becomes a practical impossibility.

At least that is the theory, but there is a way round this, a methodology that was used by the Ethereum Foundation to rewrite the history of ETH back on 20th July 2016.

The Ethereum Mainnet was released on 30th July 2015. In April 2016, The DAO was launched on the Ethereum network as a digital decentralised autonomous organisation, exactly the type of development for which Ethereum was invented. From Wikipedia:

“The DAO had an objective to provide a new decentralized business model for organizing both commercial and non-profit enterprises. It was instantiated on the Ethereum blockchain and had no conventional management structure or board of directors. The code of the DAO is open-source.”

All well and good, but the code contained a vulnerability which allowed an individual to remove one-third of the funds held by The DAO into their own wallet, a total of 3.6 million ETH valued at around $50mm at the time and around $4.7 billion today.

The Ethereum community was split on how to respond – some saw this as simple theft, whereas others saw it as malevolent but acceptable as this action was allowed by the coding.

Ethereum was hard forked to allow those who lost ETH in the exploit to recover their lost funds, in effect rewriting history. This chain is the one we know and love today as ETH.

The purists kept the original chain going, now known as ETC (Ethereum Classic). Given their relative prices of ETH at $1,300 and ETC at $30, it is easy to assess which one has been the more successful.

…

Exploiting code vulnerabilities has often been a thing. Though the safeguards and practices around code development, and auditing, are improving daily, the world will always be an imperfect place.

There is also the issue of outright theft. Crypto maximalists chant “not your keys, not your crypto” which suggests that if you know someone else’s private keys, you also own their crypto. It is true that if you know the private keys you are physically able to empty the associated wallet, but that does not make it legal to do so.

Phishing scams that scalp private keys remain just that – scams.

…

To combat these issues, the idea of a reversible coin has been proposed.

This is how it would work.

Owners of ETH would deposit funds into a contract that issued rETH (reversible ETH). Stanford University blockchain researcher Kaili Wang explained:

“The major hacks we've seen are undeniably thefts with strong evidence. If there was a way to reverse those thefts under such circumstances, our ecosystem would be much safer. Our proposal allows reversals only if approved by a decentralized quorum of judges.”

If someone believes their funds have been stolen, they can submit a freeze request which would be considered by a decentralised court of judges. Such a request would have to be made within a day or two of the disputed transaction, both sides would provide evidence as to the legitimacy of the transaction or not, and a decision would be made in the following days.

…

The researchers admit themselves that there is much work to do on the mechanics, but the development of ideas like this will greatly enhance the security and legitimacy of the crypto world.

Comments