21st August 2024 > > Global fiat liquidity part 2.

- Aug 21, 2024

- 2 min read

tl;dr

Global fiat liquidity part two.

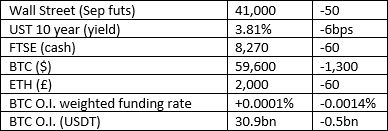

Market Snap

Market Wrap

Mt. Gox moved 13,265 BTC, worth about three-quarters of a billion dollars, and the muppets got scared again taking us from $61k to sub $59k. We all know these coins will be distributed to early-adopter creditors, and we all know most of those creditors are strong hands. Something similar happened the last time Mt. Gox moved some coins after which we saw a $53k handle, albeit on a much larger transfer.

I do wonder to what degree these irrational price changes in the face of precisely no new information of note is driven by outsize futures orders overwhelming spot liquidity.

On the flipside, I read that FTX is starting its distribution to creditors in Q4, which is going to be good news. How so, you ask? $12.7bn of cash not cryptos will be returned to investors, much of which will likely flow back into cryptos.

If $1bn of sales causes a $2k crash when met with willing buyers, what is the price increase from 10x that amount with few willing sellers to meet the new demand?

Curious Cryptos’ Commentary – Global fiat liquidity part 2

I wasn’t planning a follow-on from yesterday’s CCC, but the Milk Road last night added some more spice to the mix by bringing this to my attention:

M2 is a measure of fiat liquidity, which we discussed yesterday. More dollars in circulation equates to higher prices for hard assets.

$DXY is the measure of the value of the US Dollar against a basket of foreign currencies. It is impacted by trade flows and trends over the long-term, and by largely domestic decisions in the short-term, absent global macro events that might lead to a risk-off scenario. The expectation of interest rate cuts – though futures pricing currently underestimates the extent and speed of those cuts – is the driving force for DXY right now, and it is headed in one direction only.

Goods priced in dollars – commodities, gold, and cryptos – respond to a lower DXY with higher prices, for obvious reasons. The correlation with BTC looks like this:

Source: @sistineresearch

Comments