14th January 2026 > > The CLARITY Act, again.

- Mark Timmis

- 2 hours ago

- 2 min read

tl;dr

Developments and regression for The CLARITY Act.

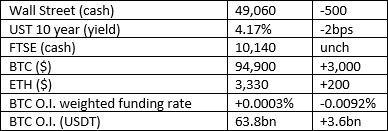

Market Snap

Market Wrap

$630bn inflows to the spot BTC ETFs yesterday has given the market a nice little push with a brief foray to $96k for the first time since November. Stocks have posting new ATHs regularly over the last few months whilst BTC has seriously underperformed. Is that the new normal, or will we see mean reversion kick in? It’s all down to the spot BTC ETF flows that will accelerate once The CLARITY Act reaches the statute book.

Curious Cryptos’ meme corner

h/t The Milk Road

Curious Crypto’s Commentary – The CLARITY Act

It’s that old two-steps forward, one-step back scenario for The Clarity Act despite the CCC’s hopes and aspirations we discussed yesterday (https://www.curiouscryptos.com/post/13th-january-2026-the-clarity-act).

The Senate Banking Committee has released a draft of an amended act that partially addresses the issues around the use of rewards and incentives for holders of USD stablecoins:

At 278 pages long (there is never-ending work for lawyers in Washington) the key change out of the 75 amendments is to formalise the scenarios in which entities can offer users of stablecoins activity-based rewards. If you recall, the TradFi industry has been vocal in its demands that holders of stablecoins can never receive interest or interest-like receipts for that could be very damaging to the bonus pools for senior executives as depositors flee traditional banking accounts for all the benefits of holding stable coins instead, though they are not quite so explicit about it.

This latest draft is the usual compromise, forbidding issuers of stablecoins from sharing the proceeds they receive from holding cash or cash-like collateral to back the stablecoin at a greater than 100% collateralisation with holders of the stablecoin. However, any activity by holders of the stablecoin (e.g. us of specific wallets, platforms, etc) can be rewarded. Normally, I don’t like solutions like this, that try to appease both sides of the argument, especially when TradFi is so very clearly in the wrong. But I can accept this approach partly because it is more likely to receive bipartisan approval as it is in line with The GENIUS Act, but also because it only takes a minute or so to understand that the crypto world has got exactly what it is asking for, but in a disguised form that will not be apparent to the naysayers.

Those are the steps forward.

In contract, the Senate Agriculture Committee has delayed its markup. Committee Chairman John Boozman explains:

“To finalize the remaining details and ensure the broad support this legislation requires, additional time is needed before moving to markup. The committee will mark up this legislation during the last week of January.”

If John gets that bipartisan support, the delay can be tolerated.

Comments