17th March 2024 > > The UK & Vanguard.

- Mark Timmis

- Mar 17, 2024

- 3 min read

tl;dr

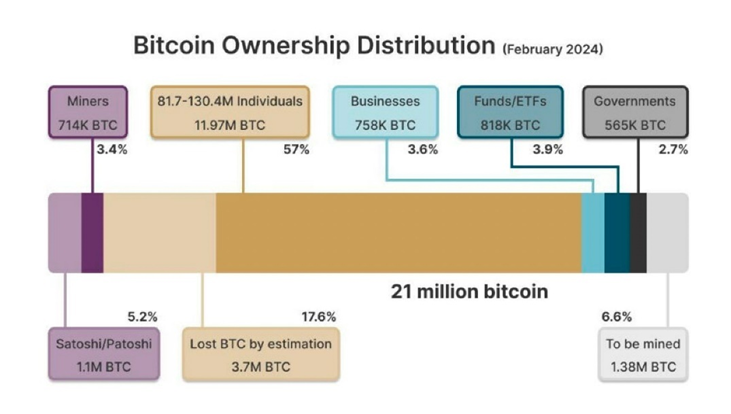

The supply shock in graphic detail. The UK government preaches a pretence that a leading newspaper has fallen for, but we are not fooled. Vanguard ploughs an increasingly lonely furrow, but not one that appeals to my default contrarian nature.

Market Snap

Market Wrap

There was a brief recapture of $70k but we quickly sold off again leaving us approximately 10% of the recent ATH. Such moves have been common enough in the past and the lack of ETF activity during the weekend probably makes such a move more likely. The key question is how do holders and potential buyers of the ETFs react to their first bout of downside volatility. We will know more about their resilience or otherwise tomorrow afternoon.

Curious Cryptos’ Commentary – An interesting graphic to cut out and keep

Curious Cryptos’ Commentary – The UK

UK regulator the FCA, commonly known as F*** Clients Anywhichway (a title that is more appropriate, though probably unofficial), has made a startling U-turn.

Sort of.

The FCA announced last Tuesday that “it would not object to requests from the London Stock Exchange and other authorised exchanges to list crypto asset tradeable securities known as exchange-traded notes.”

In response, a leading newspaper made the baseless claim that this minor announcement was the reason for driving the price of BTC to an ATH of $72k just minutes later (happenstance is not causation), thus completely ignoring the impact of spot BTC ETFs that are proving reliably popular in the US. This is such a basic error of understanding of how finance works it must surely be embarrassing for both the writer and the editor of that section of the newspaper that it was allowed to go to print. But each to their own.

But that is not all. The writer lets his paper down again in the very same article by repeating those tired old tropes that have been roundly dismissed. For the record, this is what ignorance sounds like:

“Sceptics say it is the favoured currency of terrorists, money launderers and fraudsters, as well as being in a gigantic bubble.”

“Sceptics” say all sorts of things, but when they state something that has been proven to be factually inaccurate, I am not sure why a newspaper would report such spouting of nonsense. The favoured currency of terrorists, money launderers, and fraudsters remains cash dollars, closely followed by the EUR 500 note. Cryptos don’t even touch the sides, as the US Federal Reserve recently attested to.

But hey, why let facts get in the way of your prejudice?

…

The “Sort of” comment above is because this fake reversal of previous policy by the FCA only applies to professional investors, and has been roundly rejected by firms such as BlackRock. It has its reasons for this rejection, which you should not have interest in, for some aspects are quite arcane, and we all have other stuff in our lives outside of cryptos. No, really, we do.

But this rejection by investment leaders demonstrates that the F*** Clients Anywhichway (FCA) approach is no more than a playground pretence of being crypto-friendly whilst achieving the exact opposite outcome.

Rishi Sunak’s personal anti-crypto army, by recruiting agents such as the newspaper referred to above, is proving somewhat more effective than Warren’s.

We will all be poorer for it.

Curious Cryptos’ Commentary – Defund Vanguard!

Vanguard’s CEO, despite suddenly announcing he was stepping down (with a suitably long interval which the PR department assures me has nothing to do with the vesting or otherwise of previously awarded bonus shares), has doubled down saying that BTC “does not belong in a long-term portfolio” and also that it’s “not a store of value”.

Well, that is one opinion amongst many, and one has to assume he knows a thing or two about the investment world.

Still, he hasn’t convinced me to cash in my x10 plus (>1000%) investment just yet, or ever to be honest.

Comments